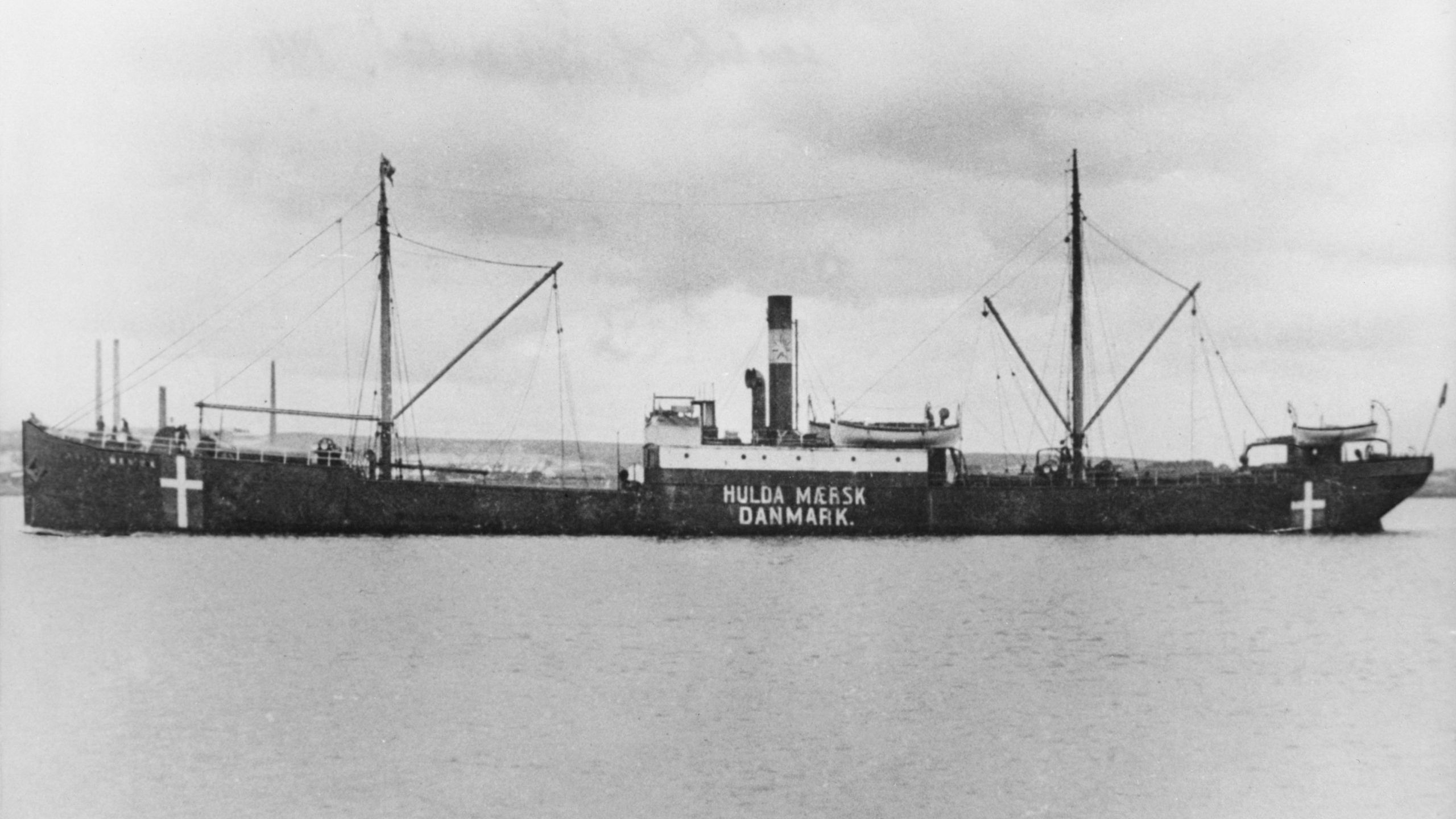

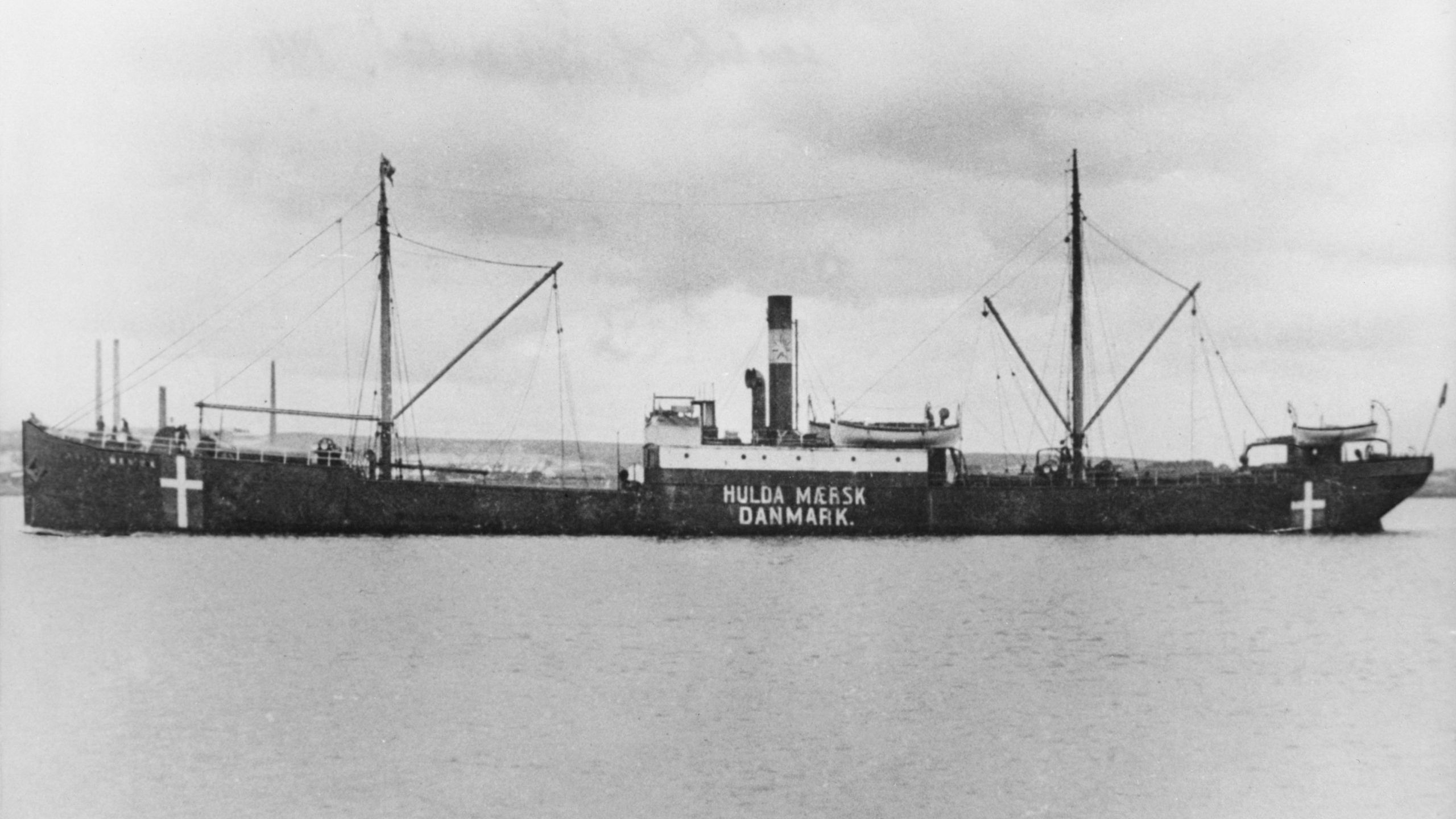

1912

The calculated risk – starting a business

When A.P. Møller established a second shipping company in 1912, he took on the entire risk himself. Had the markets turned, he would have been in dire straits…

A.P. Møller

Was born in 1876 and 19 years later he started an international career working in various shipping and trading houses, first in England, then Germany and from 1899 also in St. Petersburg, Russia.

A.P. Møller returned to Denmark in 1904 where he joined C.K. Hansen, a leading Danish shipowner. A.P. Møller was to be the head of the chartering department, but his contract allowed him to own and operate a few vessels privately. That was the start of today’s A.P. Moller – Maersk.

In 1912, A.P. Møller decided to become self-employed and he established a second shipping company – the Shipping Company of 1912. The ambition was to create a base for faster growth compared to the Shipping Company Svendborg (est. 1904), and years later A.P. Møller himself described the start:

“The start of the company was the purchase of two rather antiquated ships, built in 1899, from C.K. Hansen for DKK 150,000 each. A provincial bank demonstrated their confidence in me by giving the company a loan of DKK 275,000 against a mortgage on the ships and my personal guarantee. The share capital was set at DKK 50,000, of which I personally subscribed DKK 40,000, and against these shares I borrowed a further DKK 25,000. People who go only by the rule book, of which there are many these days, me included, would no doubt think such a start reckless, even indeed the work of a madman; yet there was method in my madness…”

A.P. Møller

A well calculated risk

The original statutes of the company highlight the risks that the entrepreneur was willing to take: As the managing owner, A.P. Møller was entitled to –

“sell and mortgage the company’s ships, raise loans against bills of exchange or other security, and purchase new ships for the company when such are considered beneficial, for all of which, however, he is to be answerable to the general meeting”.

It was a risk, but well calculated as the company came off to a flying start.

1886

Five Generations of the Mærsk family

Based on more than 20 years of experience as a captain on sailing ships, Peter Mærsk Møller acquired the small steamer ‘Laura’ and took the family company from sail to steam.

1904

The Mærsk family companies

A.P. Møller, strongly supported by his father, captain Peter Mærsk Møller, established the Steamship Company Svendborg, the forerunner of today’s A.P. Moller – Maersk.

1912

The calculated risk – starting a business

A.P. Møller founded the Steamship Company of 1912. The objective was to create a base for growth.

1913

Growth and Consolidation

A.P. Møller set up a small office to act as the manager of the fleets of the Svendborg and 1912 companies. The first transactions in brokerage of ships and cargoes took place.

1928

A.P. Møller was asked by the Danish government to take up the presidency of Danske Bank

He remained the Chair until 1952, taking the bank from public to private ownership. During this time, A.P. Møller and the shipping companies invested in the bank.

1940

The family partnership

Mærsk Mc-Kinney Møller became a partner in “Firmaet A.P. Møller”.

1953

The A.P. Moller Foundation as an owner

The A.P. Moller Foundation was established to ensure a long-term, stable ownership structure of the Maersk activities. A.P. Møller was the Chair, and Mærsk Mc-Kinney Møller was a board member.

1962

Into energy - for the greater good

A.P. Møller, together with the Steamship Company Svendborg and the Steamship Company of 1912, was awarded the concession for exploration and extraction of raw materials in the Danish underground.

1965

Mærsk Mc-Kinney Møller

Mærsk Mc-Kinney Møller became senior partner and Chair of the Svendborg and 1912 companies, the shipyard, other companies and the foundations after his father, A.P. Møller’s death on 12 June 1965.

1970

A strategy for the A.P. Moller Group

The direction for the next 45 years of expansion was laid in a strategy for The A.P. Moller Group.

1986

Engagement over time – the family in the Foundations

Ane Mærsk Mc-Kinney Uggla became a member of the board of the A.P. Moller Foundation, today’s owner of A.P. Moller Holding.

1993

After 28 years at the helm of the Group, Mærsk Mc-Kinney Møller stepped down from daily management.

Mærsk Mc-Kinney Møller remained Chair of the Foundations, the Svendborg and 1912 companies and the Odense Steel Shipyard.

2003

The Origin of the Core Values

Mærsk Mc-Kinney Møller retired from most presidencies in the A.P. Moller – Maersk Group. Ane Mærsk Mc-Kinney Uggla became the Co-chair of A.P. Moller – Maersk. Mærsk Mc-Kinney Møller introduced the five Core Values, based on his father’s leadership principles.

2012

Ane Mærsk Mc-Kinney Uggla

Ane Mærsk Mc-Kinney Uggla became the Chair of the A.P. Moller Foundation when Mærsk Mc-Kinney Møller died on 16 April 2012.

2013

A.P. Moller Holding was established to act as the investment arm of the A.P. Moller Foundation

The majority ownership of A.P. Moller – Maersk was transferred to A.P. Moller Holding from the A.P. Moller Foundation. Ane Mærsk Mc-Kinney Uggla became the Chair of A.P. Moller Holding.

2015

A.P. Moller Holding

Adding to its 2.98% holding, A.P. Moller Holding acquired 15% of Danske Bank’s total share capital as part of A.P. Moller – Maersk’s divestment of the same. Following the 15% acquisition, A.P. Moller Holding bought an extra 2.02% to fulfill the ambition of a total ownership of 20%.

2016

Robert M. Uggla

Robert M. Uggla became the CEO of A.P. Moller Holding. A.P. Moller – Maersk was restructured into two independent divisions; an integrated Transport & Logistics division and an Energy division.

2017

The Africa Infrastructure Fund

The Africa Infrastructure Fund was established by A.P. Moller Capital, which was founded to manage stand-alone funds focusing on infrastructure in emerging markets. Maersk Tankers was acquired by A.P. Moller Holding from A.P. Moller – Maersk.

2018

Maersk Oil

Maersk Oil was divested from A.P. Moller – Maersk to Total S.A.

2019

Maersk Drilling

At the public listing of Maersk Drilling, A.P. Moller Holding retained a 41.26% share of the company. A.P. Moller Holding acquired KK Group.