1953

The A.P. Moller Foundation as an owner

The A.P. Moller Foundation was created to ensure a family-controlled ownership structure of the business activities “in the spirit of A.P. Møller”; the deed of the Foundation spells out the purpose of A.P. Moller Holding.

The A.P. Moller Foundation

As the investment arm of the A.P. Moller Foundation, the purpose of A.P. Moller Holding is to exercise the Foundation’s role as an engaged owner in the spirit of A.P. Møller, and to ensure that the Foundation can continue to contribute to society in the form of donations for generations to come.

In 1953

When A.P. Møller established the Foundation, he did so by mutual understanding with his three children, thus ensuring agreement on how ownership control would transition over generations.

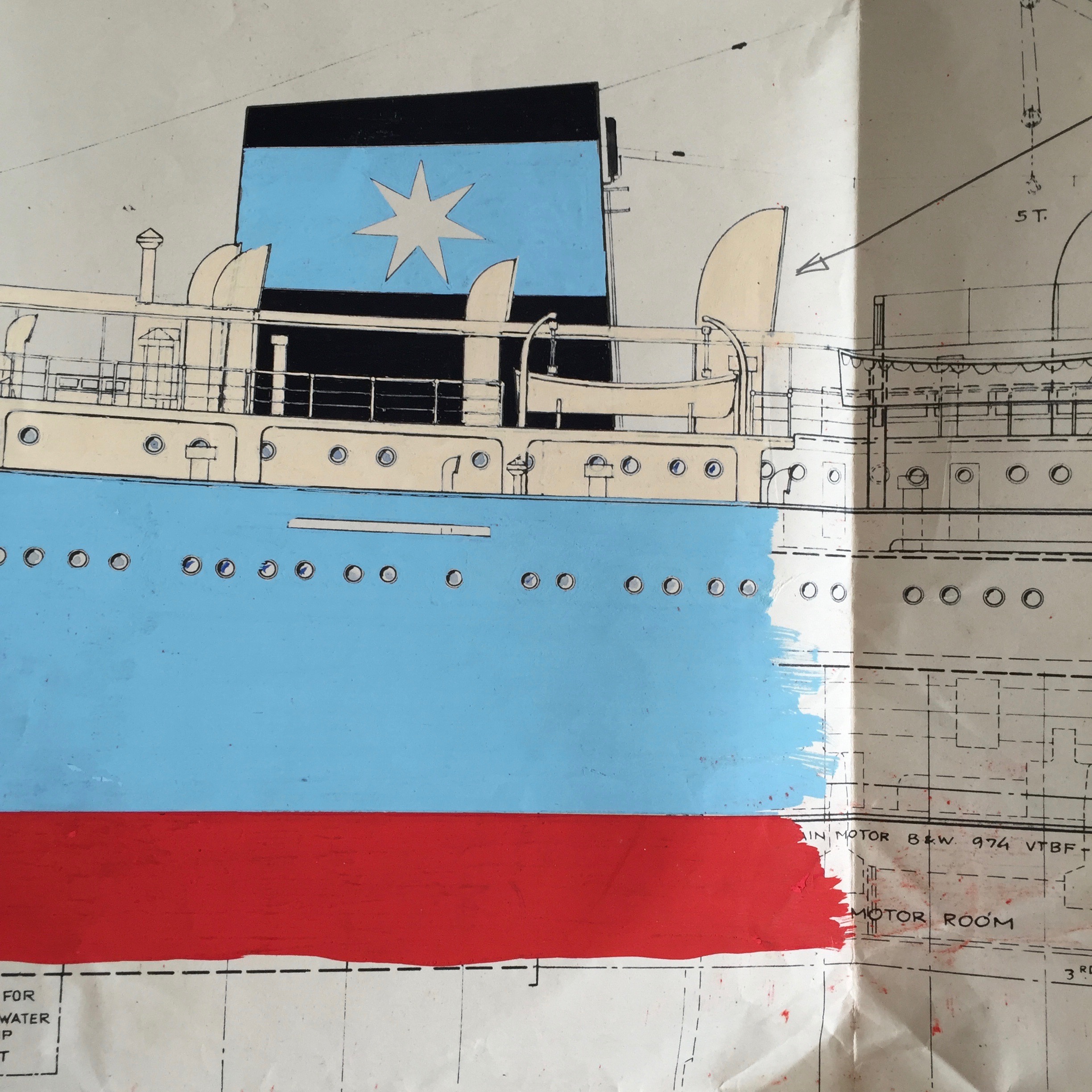

Although comprising activities in diverse sectors, the Group’s main business consisted of two jointly operated shipping companies and the Odense Steel Shipyard. It was crucial for A.P. Møller that these activities would continue to be managed in accordance with his business principles.

“In the spirit of A.P. Møller”

Is the phrase derived from the deed of the Foundation, where A.P. Møller explains his business principles in three short statements, saying that the companies:

- “…must be well consolidated…”

- “…must build up activities and have a positive impact on society…”

- “…that paying out dividends is of secondary importance…”

The three statements

The first statement is a direct reference to the volatile nature of the shipping market; depreciation and savings were made to safeguard the viability of the business over the economic cycles.

Secondly, the liberally minded A.P. Møller saw business activities as a useful means for a positive development of society.

The third principle implies that profits from the business activities should be reinvested in the existing business or used for “the build-up of useful activities”; only when principles 1 and 2 are fulfilled will the shareholders receive a dividend.

A.P. Moller Holding

Was established in 2013 and represents the next step in safeguarding the long-term viability of the A.P. Moller Group companies over generations.

Learn more about the A.P. Moller Foundation via the link (only available in Danish).

1886

Five generations of the Mærsk family

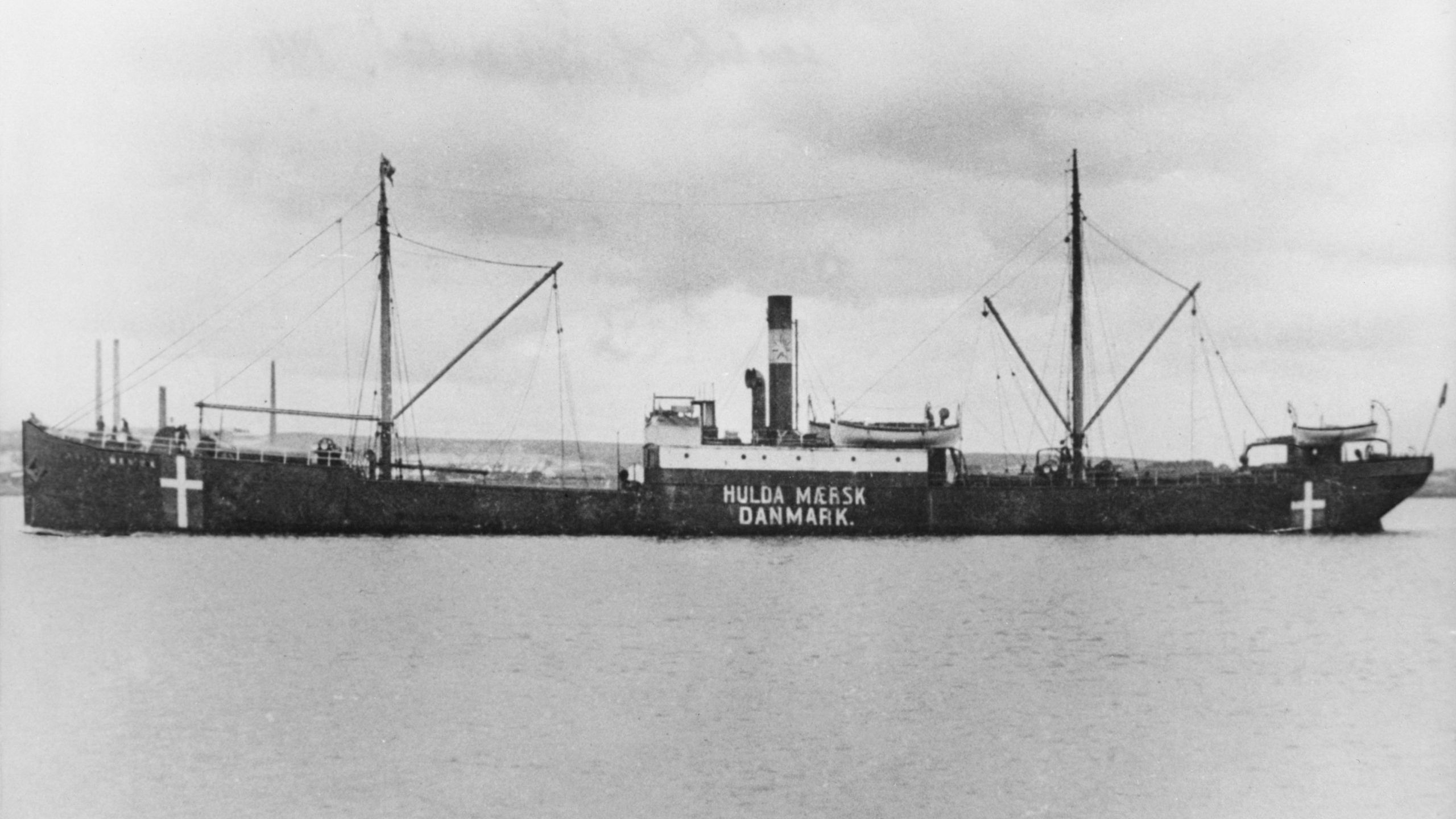

Based on more than 20 years of experience as a captain on sailing ships, Peter Mærsk Møller acquired the small steamer ‘Laura’ and took the family company from sail to steam.

1904

The Mærsk family companies

A.P. Møller, strongly supported by his father, captain Peter Mærsk Møller, established the Steamship Company Svendborg, the forerunner of today’s A.P. Moller – Maersk.

1912

The calculated risk – starting a business

A.P. Møller founded the Steamship Company of 1912. The objective was to create a base for growth.

1913

Growth and consolidation

A.P. Møller set up a small office to act as the manager of the fleets of the Svendborg and 1912 companies. The first transactions in brokerage of ships and cargoes took place.

1928

A.P. Møller was asked by the Danish government to take up the presidency of Danske Bank

He remained the Chair until 1952, taking the bank from public to private ownership. During this time, A.P. Møller and the shipping companies invested in the bank.

1940

The family partnership

Mærsk Mc-Kinney Møller became a partner in “Firmaet A.P. Møller”.

1953

The A.P. Moller Foundation as an owner

The A.P. Moller Foundation was established to ensure a long-term, stable ownership structure of the Maersk activities. A.P. Møller was the Chair, and Mærsk Mc-Kinney Møller was a board member.

1962

Into energy - for the greater good

A.P. Møller, together with the Steamship Company Svendborg and the Steamship Company of 1912, was awarded the concession for exploration and extraction of raw materials in the Danish underground.

1965

Mærsk Mc-Kinney Møller

Mærsk Mc-Kinney Møller became senior partner and Chair of the Svendborg and 1912 companies, the shipyard, other companies and the foundations after his father, A.P. Møller’s death on 12 June 1965.

1970

A strategy for the A.P. Moller Group

The direction for the next 45 years of expansion was laid in a strategy for The A.P. Moller Group.

1986

Engagement over time – the family in the Foundations

Ane Mærsk Mc-Kinney Uggla became a member of the board of the A.P. Moller Foundation, today’s owner of A.P. Moller Holding.

1993

After 28 years at the helm of the Group, Mærsk Mc-Kinney Møller stepped down from daily management.

Mærsk Mc-Kinney Møller remained Chair of the Foundations, the Svendborg and 1912 companies and the Odense Steel Shipyard.

2003

The origin of the Core Values

Mærsk Mc-Kinney Møller retired from most presidencies in the A.P. Moller – Maersk Group. Ane Mærsk Mc-Kinney Uggla became the Co-chair of A.P. Moller – Maersk. Mærsk Mc-Kinney Møller introduced the five Core Values, based on his father’s leadership principles.

2012

Ane Mærsk Mc-Kinney Uggla

Ane Mærsk Mc-Kinney Uggla became the Chair of the A.P. Moller Foundation when Mærsk Mc-Kinney Møller died on 16 April 2012.

2013

A.P. Moller Holding was established to act as the investment arm of the A.P. Moller Foundation

The majority ownership of A.P. Moller – Maersk was transferred to A.P. Moller Holding from the A.P. Moller Foundation. Ane Mærsk Mc-Kinney Uggla became the Chair of A.P. Moller Holding.

2015

A.P. Moller Holding

Adding to its 2.98% holding, A.P. Moller Holding acquired 15% of Danske Bank’s total share capital as part of A.P. Moller – Maersk’s divestment of the same. Following the 15% acquisition, A.P. Moller Holding bought an extra 2.02% to fulfill the ambition of a total ownership of 20%.

2016

Robert M. Uggla

Robert M. Uggla became the CEO of A.P. Moller Holding. A.P. Moller – Maersk was restructured into two independent divisions; an integrated Transport & Logistics division and an Energy division.

2017

The Africa Infrastructure Fund

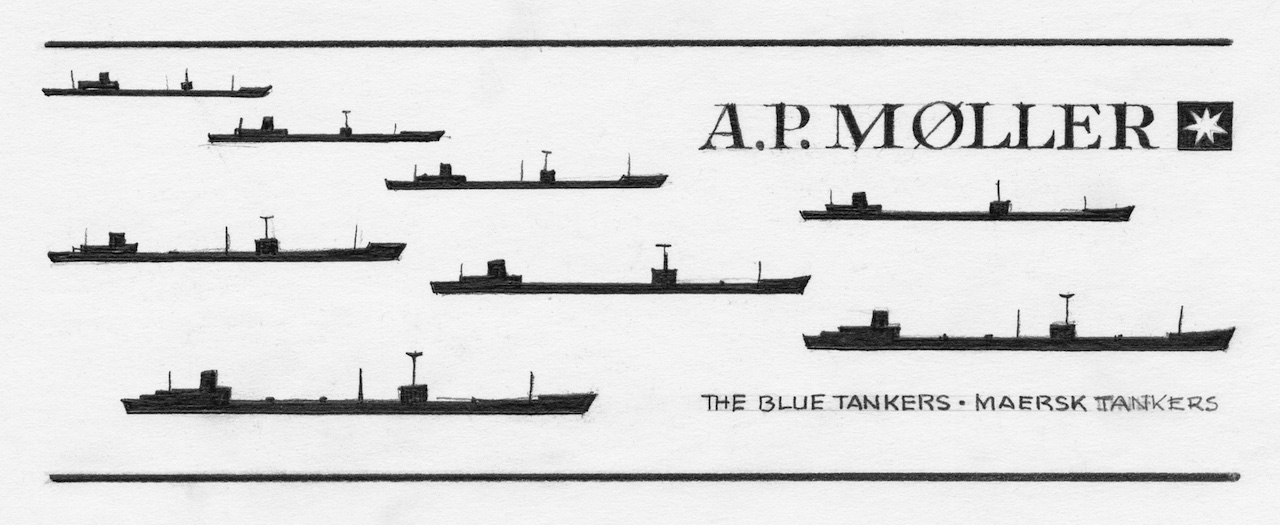

The Africa Infrastructure Fund was established by A.P. Moller Capital, which was founded to manage stand-alone funds focusing on infrastructure in emerging markets. Maersk Tankers was acquired by A.P. Moller Holding from A.P. Moller – Maersk.

2018

Maersk Oil

Maersk Oil was divested from A.P. Moller – Maersk to Total S.A.

2019

Maersk Drilling

At the public listing of Maersk Drilling, A.P. Moller Holding retained a 41.26% share of the company. A.P. Moller Holding acquired KK Group.