1962

Into energy - for the greater good

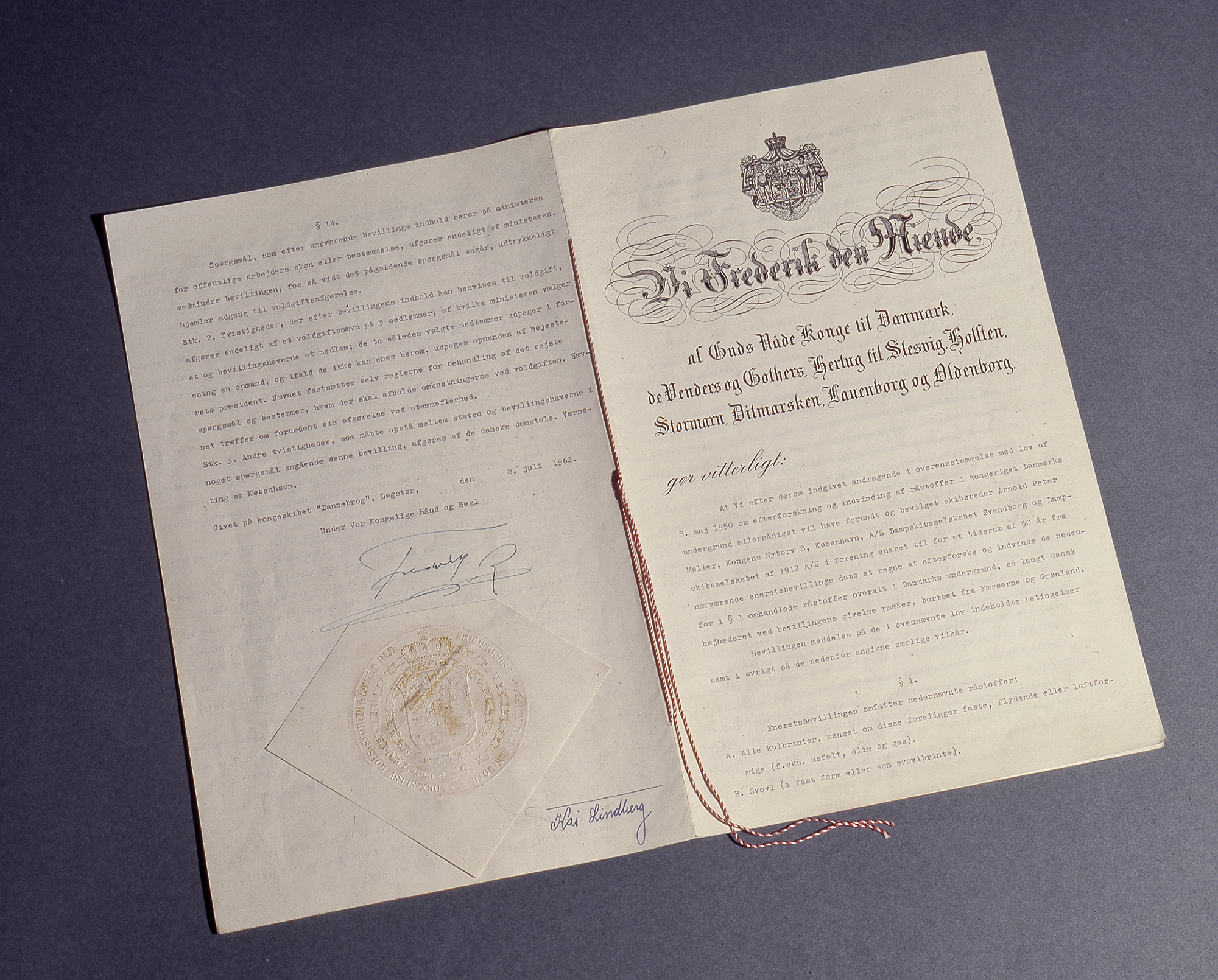

In the summer of 1962, when the Danish government awarded the Sole Concession for exploration and production of oil and gas in the Danish subsoil to A.P. Møller, no one could imagine the future impact on society and for the company.

The beginning

It is safe to say that even A.P. Møller himself did not have the insight to see the full potential when the story began in 1959; foreign parties showed interest in the rights to operate in Denmark, but A.P. Møller advised against it.

His motivation was to keep the rights and the business in Danish hands and soon realised that “having the ability also means accepting the duty”. In 1960, in a letter to the Prime Minister, A.P. Møller stated that:

“…In the national interest, my organisation is willing to consider such action [drilling operations] and I ask the government to take this into account.”

First and second phase of Mærsk Oil

His Majesty King Frederik IX signed the Sole Concession on 8 July 1962 and the first phase of the Maersk Oil story began. With partners, Maersk Oil established the Danish Underground Consortium and the exploration efforts were initiated.

In the second phase from 1963 to 1973 the focus moved from land-based operations to the Danish part of the North Sea. The first commercially viable finds were in 1966 and production from the “Dan Field” started in 1972.

Third and fourth phase

The years marked by high oil prices from 1973 to 1985 frame the third phase, where the Danish Underground Consortium implemented a major expansion of the production system in the Danish North Sea fields.

The first gas sales agreement was made with the Danish government, which on the other hand made significant, politically motivated, cuts into the A.P. Møller concession.

A fourth phase began when oil prices dropped in 1985. This was a catalyst to initiate various technological innovations that in turn would lead to more efficient operations and new opportunities outside Denmark.

In 1994

Maersk Oil started the build-up in Qatar, the first agreement in the company’s final phase where it expanded from Danish to international operations.

By 2007, Maersk Oil’s international production exceeded the Danish production. A.P. Moller – Maersk decided to divest the energy related activities in 2016, and consequently Maersk Oil was sold to TOTAL S.A. in 2018.

Maersk Oil

And the offshore related initiatives that followed, originally were not a strategic choice based on commercial motives.

A.P. Møller’s national sentiment led him to apply for the Concession, partly without knowing the potential for hydrocarbon discoveries in the North Sea – which over time would form the basis for Maersk Oil’s success in oil and gas production.

1886

Five generations of the Mærsk family

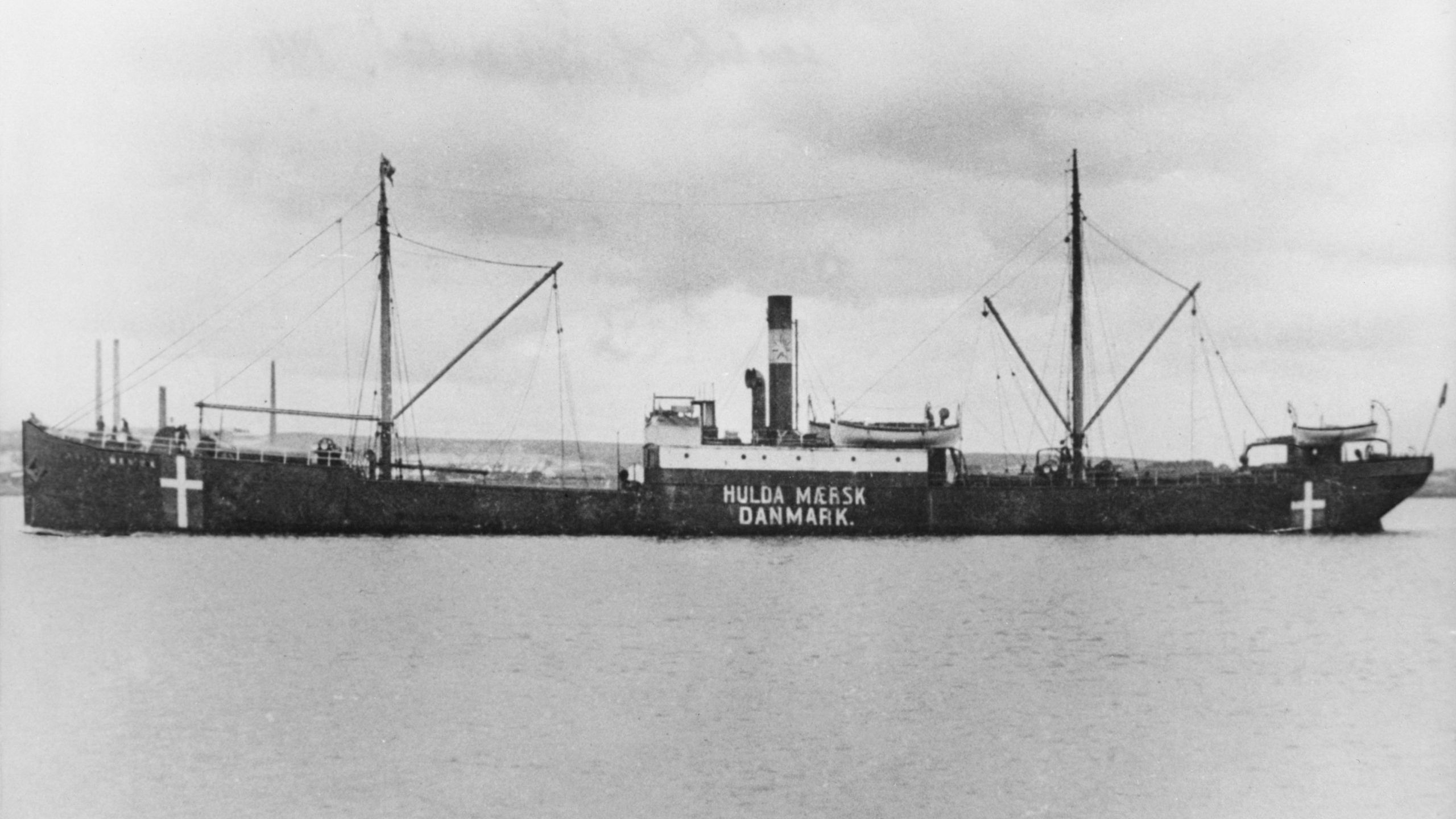

Based on more than 20 years of experience as a captain on sailing ships, Peter Mærsk Møller acquired the small steamer ‘Laura’ and took the family company from sail to steam.

1904

The Mærsk family companies

A.P. Møller, strongly supported by his father, captain Peter Mærsk Møller, established the Steamship Company Svendborg, the forerunner of today’s A.P. Moller – Maersk.

1912

The calculated risk – starting a business

A.P. Møller founded the Steamship Company of 1912. The objective was to create a base for growth.

1913

Growth and consolidation

A.P. Møller set up a small office to act as the manager of the fleets of the Svendborg and 1912 companies. The first transactions in brokerage of ships and cargoes took place.

1928

A.P. Møller was asked by the Danish government to take up the presidency of Danske Bank

He remained the Chair until 1952, taking the bank from public to private ownership. During this time, A.P. Møller and the shipping companies invested in the bank.

1940

The family partnership

Mærsk Mc-Kinney Møller became a partner in “Firmaet A.P. Møller”.

1953

The A.P. Moller Foundation as an owner

The A.P. Moller Foundation was established to ensure a long-term, stable ownership structure of the Maersk activities. A.P. Møller was the Chair, and Mærsk Mc-Kinney Møller was a board member.

1962

Into energy - for the greater good

A.P. Møller, together with the Steamship Company Svendborg and the Steamship Company of 1912, was awarded the concession for exploration and extraction of raw materials in the Danish underground.

1965

Mærsk Mc-Kinney Møller

Mærsk Mc-Kinney Møller became senior partner and Chair of the Svendborg and 1912 companies, the shipyard, other companies and the foundations after his father, A.P. Møller’s death on 12 June 1965.

1970

A strategy for the A.P. Moller Group

The direction for the next 45 years of expansion was laid in a strategy for The A.P. Moller Group.

1986

Engagement over time – the family in the Foundations

Ane Mærsk Mc-Kinney Uggla became a member of the board of the A.P. Moller Foundation, today’s owner of A.P. Moller Holding.

1993

After 28 years at the helm of the Group, Mærsk Mc-Kinney Møller stepped down from daily management.

Mærsk Mc-Kinney Møller remained Chair of the Foundations, the Svendborg and 1912 companies and the Odense Steel Shipyard.

2003

The origin of the Core Values

Mærsk Mc-Kinney Møller retired from most presidencies in the A.P. Moller – Maersk Group. Ane Mærsk Mc-Kinney Uggla became the Co-chair of A.P. Moller – Maersk. Mærsk Mc-Kinney Møller introduced the five Core Values, based on his father’s leadership principles.

2012

Ane Mærsk Mc-Kinney Uggla

Ane Mærsk Mc-Kinney Uggla became the Chair of the A.P. Moller Foundation when Mærsk Mc-Kinney Møller died on 16 April 2012.

2013

A.P. Moller Holding was established to act as the investment arm of the A.P. Moller Foundation

The majority ownership of A.P. Moller – Maersk was transferred to A.P. Moller Holding from the A.P. Moller Foundation. Ane Mærsk Mc-Kinney Uggla became the Chair of A.P. Moller Holding.

2015

A.P. Moller Holding

Adding to its 2.98% holding, A.P. Moller Holding acquired 15% of Danske Bank’s total share capital as part of A.P. Moller – Maersk’s divestment of the same. Following the 15% acquisition, A.P. Moller Holding bought an extra 2.02% to fulfill the ambition of a total ownership of 20%.

2016

Robert M. Uggla

Robert M. Uggla became the CEO of A.P. Moller Holding. A.P. Moller – Maersk was restructured into two independent divisions; an integrated Transport & Logistics division and an Energy division.

2017

The Africa Infrastructure Fund

The Africa Infrastructure Fund was established by A.P. Moller Capital, which was founded to manage stand-alone funds focusing on infrastructure in emerging markets. Maersk Tankers was acquired by A.P. Moller Holding from A.P. Moller – Maersk.

2018

Maersk Oil

Maersk Oil was divested from A.P. Moller – Maersk to Total S.A.

2019

Maersk Drilling

At the public listing of Maersk Drilling, A.P. Moller Holding retained a 41.26% share of the company. A.P. Moller Holding acquired KK Group.